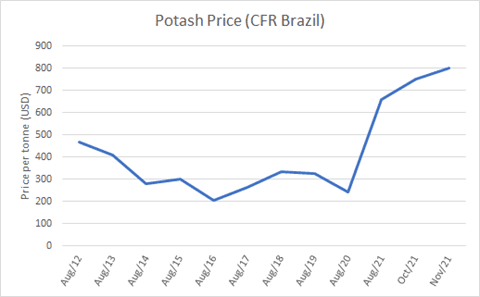

After a decline through much of the summer, the price of potash has been on the rise and experts anticipate even higher growth in the next few months, which could signal opportunities for potash investing.

As shown in the following graph, the price per tonne reached a low of US$ 200, but within a few weeks, jumped past US$ 700.

Source: Acerto Limited Report, Agribusiness Intelligence for Latin America.

John Baffes and Wee Chian Koh from World Bank predict that potash will remain in strong demand for at least the rest of this year.

What is Potash? A look at the current potash demand

Potash is a common name for several compounds containing potassium, such as potassium sulphate (K2SO4) or potassium-magnesium sulphate (K2SO4-MgSO4).

Potash is mostly used as fertilizer, as it contains water-soluble potassium, a nutrient which helps plants grow healthier. The ingredient can be found in different forms, such as SOP (sulphate of potash), MOP (muriate of potash), glauconitic siltstone (potassium silicate) and more.

According to a FAO report entitled “The State of The World’s Land and Water Resources for Food and Agriculture,” the demand for potash to be used in food production is expected to grow in the next few decades, a factor that those interested in potash investing could consider.

This need is based on a projected gradual decline in the amount of land available for agricultural use worldwide up to 2050. While farmland is decreasing, the global population is doing the opposite, and this projected increase is accompanied by a higher demand for food. Meeting this need could mean more potash will be needed for food production.

The potash-price situation is a factor in potash investing

According to the World Bank, recent strong demand from key crop-growing regions has been “the driving force behind high fertilizer prices.”

Although potash investing has experienced ups and downs over the years, 2021 has seen significant increases. In November 2021 it reached an average price of US$800/t. The largest price rise since 2009.

Most retail fertilizer prices continued to rise during October 2021, as stated by the Acerto Limited Report in the opening section.

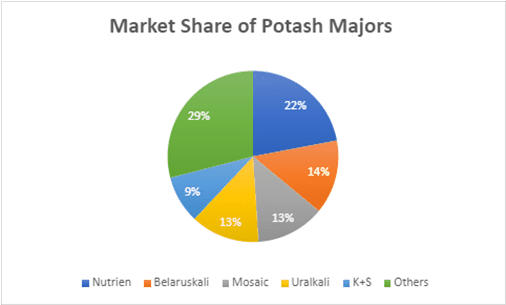

To understand more about the current potash-price situation, it’s important to learn how potash production is divided globally. Worldwide potash production is controlled by Canada, Belarus, and Russia.

Within these countries, five companies control more than 70% of all global production. These include:

- Nutrien;

- Belaruskali;

- Mosaic;

- Uralkali;

- K+S.

The chart below shows the percentages these companies share in the potash market.

Source: Bloomberg Intelligence, February, 2021.

In June 2021, the EU imposed restrictive measures against the Belarusian regime. The disciplinary measures also restricted potash trade of potash with Belarus. This led to Belaruskali, a state-owned company and the world’s second-largest potash producer, taking steps to reduce its production levels, an action which impacted potash prices at a global level.

The recent high prices were also influenced by the COVID-19 pandemic to a minor degree. As explained by Andy Jung in Croplife, “global demand for agricultural products was one sector that saw relatively limited impacts from COVID-19.”

Therefore, demand continued to increase for agricultural products, such as potash fertilizers, but the capacity to supply this demand struggled to keep the pace, thanks to supply chain restrictions that have accompanied this global pandemic for more than a year.

In this sense, Scotia Capital analyst Ben Isaacson has been anticipating shifts in potash stocks. In a note to Bloomberg on April 2021, Isaacson shared that he expected potash stocks to “rally near term.”

A sharper look at potash investing

Even with potash being an important nutrient for plant growth, some aspects of its use can cause negative impacts to the environment, depending on the source of potassium utilized.

Currently, the most common method to apply potassium to crops is via potassium chloride (KCl) and potassium sulfate.

The use of these can cause an increase in soil salinity, which can cause disturbances in soil organisms and plants. This can affect their development and harm soil biodiversity.

Along with these concerns conventional potash mining may present dangers for the workforce. For instance, an overnight fire left 63 people trapped underground at Nutrien’s Allan potash mine south of Saskatoon.

Image: Fire accident at Nutrien’s potash mine. Source: Nathaniel Dove / Global News.

Potash investing can still be considered responsible investing if investors factor in the environmental and social responsibility of the potash producer companies.

Today, attention to Environmental, Social and Governance standards is increasing, as the world faces environmental and social problems across all global regions.

ESG-driven companies are gaining attention, as many countries develop new “green deals,” and gradually implement higher environmental standards. Some are optional and some are mandatory.

About Verde AgriTech

Verde AgriTech (TSX: NPK) is an agricultural technology company that develops and produces fertilizers. Rooting our solutions in nature, we make agriculture healthier, more productive, and profitable for farmers. We work to improve the health of all people and the planet.

The company is an example of an ESG-driven company, as it supplies salinity and chloride-free potassium specialty fertilizers directly to farmers for the same cost as conventional ones.

Verde’s products come from naturally-occurring glauconitic siltstone. The company’s mine has 777.28M tonnes in reserves and 1,472M tonnes in resources.

Verde raised over C$60 million over the years as it cautiously invested in exploration, project development, production, and expansions.

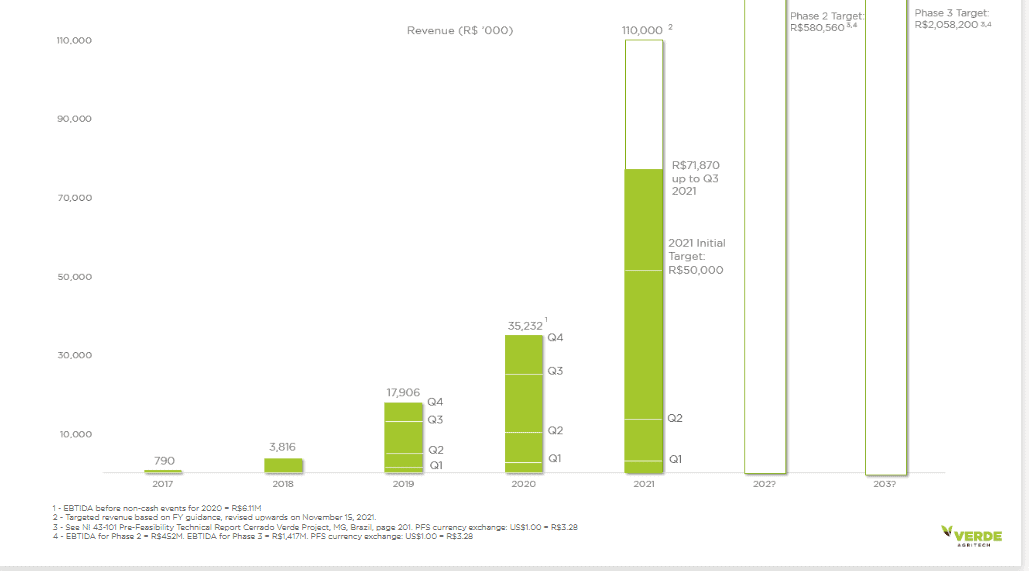

The chart below demonstrates the company’s growing revenue and what is projected for the future.

- EBTIDA before non-cash events for 2020 = R$6.11M;

- Targeted revenue based on FY guidance, revised upwards on August 16, 2021;

- See NI 43-101 Pre-Feasibility Technical Report Cerrado Verde Project, MG, Brazil, page 201. PFS currency exchange: US$1.00 = R$3.28;

- EBTIDA for Phase 2 = R$452M. EBTIDA for Phase 3 = R$1,417M. PFS currency exchange: US$1.00 = R$3.28.

People interested in potash investing can look at the company’s Q3 2021 results for more information about its recent growth or access Verde’s shareholder deck.