The fertilizer industry is riding on strong global demand, which can create opportunities to search for potash stocks to buy.

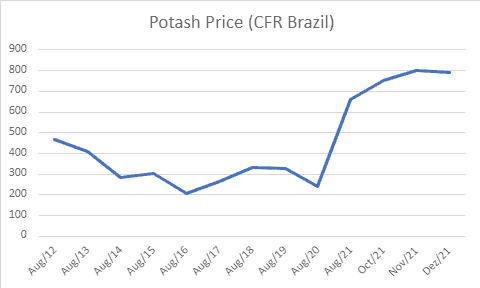

According to Investing News, the potash market “managed to weather the COVID-induced storm that plagued many of the world’s commodities in 2020,” and strong demand has pushed potash prices higher in 2021, as the chart below shows.

Source: Acerto Limited Report, Agribusiness Intelligence for Latin America.

According to the US Geological Survey (USGS) “Asia and South America were the leading consuming regions of potash (in 2020)”.

World consumption of potash was projected “to increase slightly in 2021,” with Asia and South America being the leading regions for growth, according to projections by the USGS.

Some countries have an upper hand on potash production. Canada is in the lead, the world’s largest producer and exporter of potash, as well as holding the world’s largest known potash reserves.

Beyond Canada, the world’s largest producers of potash are:

- Russia;

- Belarus;

- China;

- Germany

After understanding this scenario, it’s time to take a look at potash companies. Most of these, especially the top ones, according to sources like the IG International, are from or have their main production inside the largest potash producer’s countries. To illustrate, below is a list of publicly traded potash stocks.

Potash Stocks to buy

Verde AgriTech PLC (TSX:NPK)

Verde is an agricultural technology company that develops and produces fertilizers. Rooting their solutions in nature, Verde makes agriculture healthier, more productive, and profitable for farmers. The Company works to improve the health of all people and the planet.

Verde’s products are derived from glauconite, a mineral that has been used as a natural potassium fertilizer for over 250 years. Its mine has 777.28 MT in reserves and 1,472 MT in resources, sufficient to last generations supplying most of the Brazilian Market.

Verde also achieved a 62% of gross margin in 2020, and a CAGR of 186%, based on yearly total sales volume in tons from 2018 to 2020.

Nutrien (TSX:NTR/NYSE:NTR)

Nutrien was formed in 2018 after a merge of PotashCorp with its smaller rival Agrium. The company makes nitrogen and phosphate-based products for the agricultural industry. Most of its mines are in Canada.

Mosaic Company (NYSE: MOS)

Mosaic mines and processes phosphate and potash into crop nutrients. Although it is a U.S.-based company, it only has one mine in the country; most of its mines and refineries are in Canada.

Intrepid Potash (NYSE:IPI)

Intrepid is a U.S.-based potash producer formed in 2000. The company produces potassium, magnesium, sulfur, salt and water to help grow healthy crops and for use in the oil and gas industry, among other destinations.

K+S (ETR:SDF)

K+S is a German company and a producer of potash. It also makes magnesium and salts. Its operations are predominantly based in Germany, but it has been expanding with projects in Canada, the U.S. and Chile.

Israel Chemicals (NYSE:ICL)

Israel Chemicals, better known as ICL, is an Israeli company dual-listed in Tel Aviv and New York.

Uralkali (MCX:URKA)

Uralkali is one of the leading global producers of potash, accounting for a significant share of global potash production, from potash ore mining to the delivery of potassium chloride to customers.

Sociedad Química y Minera (NYSE:SQM)

Sociedad Química y Minera de Chile is a Chilean chemical company and a supplier of plant nutrients, iodine, lithium and industrial chemicals. SQM’s natural resources and its main production facilities are located in the Atacama Desert between Chile’s I and II regions.

Ways to evaluate possible investments risks for potash stocks to buy

Investing is usually surrounded by risks, and a way to avoid uncomfortable situations is to look closely at a company’s strong points and flaws when deciding to invest.

A good way is to consider a company’s net present value (NPV), which means the worth of a company’s net cash flow, minus its initial cash outflow. NPV is helpful because it weighs the value of time, considering that future cash flows can translate into money today.

To calculate NPV, one needs to estimate future cash flows for each period and determine the correct discount rate. If, for example, the NPV of a project or investment is positive, it means that present value of all future cash flows related to it will be positive, and consequently attractive.

Verde Agritech’s NPV, for example, is US$1.99 billion, at an 8% discount rate with an Internal Rate of Return of 287%, based on the Pre-Feasibility Study (PFS) filed on SEDAR in 2017.

Another point to consider is the current ESG standards. Green Deals are starting to become a turning point for politics and businesses around the world, so companies that are ‘Green responsible’ are gaining more visibility.

Many companies, like the ones previously mentioned, are producing potassium chloride (KCl), the most commonly used source of potash for fertilizers. However, KCl may have a biocidal effect in the soil, as explained by Heide Hermary (2007), in the article Effects of Some Synthetic Fertilizers on the Soil Ecosystem.

According to the researcher, applying 200 kg potassium chloride is equivalent to pouring 1,600 litters of bleach into the soil, damaging the soil health, damaging the soil health.

Verde is an example of an ESG-driven company: it supplies salinity and chloride-free potassium specialty fertilizers directly to Brazilian farmers for the same cost as conventional fertilizers, with the benefit of protecting and improving soil biodiversity.

Potash Stocks to buy: a difficult decision?

What can be understood is that, when it comes to investing, good research is necessary. Due diligence should include learning more about a company’s background, the situation in the country where it is based, its products, if the company is committed to ESG standards, etc.

It’s also important to understand the market of interest, including how it works and if it’s aligned with the investors’ goals.

Check out Verde’s corporate Presentation.